SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

(Rule 14a-101)

Information Required in Proxy Statement

Scheduled 14A Information

Proxy Statement Pursuant to Section 14(a)

of the Securities

Exchange Act of 1934

| | |

Filed by the Registrant þRegistrant: ☒ | | Filed by a Party other than the Registrant¨ | o |

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

Check the appropriate box:☐ | | |

| |

¨ Preliminary proxy statement | | |

|

¨Confidential, Forfor Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | |

þDefinitive Proxy Statement |

| ☐ | | |

| |

¨Definitive Additional Materials |

| ☐ | | |

|

¨Soliciting Material Pursuant to § 240.14a-12 |

TRIPLE-S MANAGEMENT CORPORATION

(Name of Registrant as Specified

inIn Its Charter)

(Name of Person(s) Filing Proxy Statement, if

Other Thanother than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.0-11 |

| (1)1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11. (Set0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

¨o | Fee paid previously with preliminary materials. |

¨o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1)1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

March 21, 2014

Dear Shareholder:

I am pleased

Triple-S Management Corporation

1441 F.D. Roosevelt Avenue – San Juan, Puerto Rico 00920

[THIS PAGE INTENTIONALLY LEFT BLANK]

It is my pleasure to invite you to our

2014 Annual Meetingannual meeting of

Shareholders,shareholders, which will be held on

Wednesday,Friday, April

30, 2014,28, 2017, at 9:00 a.m.,

Atlantic Time,local time, in our corporate offices located at

the Atlantic Room of the InterContinental Resort and Casino Hotel, 5961 Isla Verde1441 F.D. Roosevelt Avenue,

Carolina,San Juan, Puerto Rico

00979.00920.

At

thethis year’s meeting, we will

ask you to elect three directors to our Board of Directors, ratify the selection of

PricewaterhouseCoopersDeloitte & Touche LLP as

ourthe Company’s independent registered public accounting firm for

the current year,2017, vote on

thean advisory resolution to approve

ourthe compensation of the Company’s named executive

officers, vote on the frequency of future advisory votes on the compensation

of the Company’s named executive officers, vote on several amendments to the Company’s Amended and Restated Articles of Incorporation, approve the Company’s 2017 Incentive Plan, and act on any other business matter properly brought before the meeting.

This booklet, which includes a formal notice of the meeting and the proxy statement,

details the business to be conducted at the meeting and provides additional information about us and the meeting that you should consider as you cast your vote. I appreciate the time and attention you devote to reading these materials and voting your shares.

We hope

Your vote is very important to us. I encourage you

will participate in the meeting. Pleaseto vote

your shares as soon as possible

even ifwhether or not you plan to attend the meeting.

This will ensureYou may cast your

shares are represented at the meeting. You can vote over the Internet or by telephone according to the instructions in the proxy statement and the notice. As an alternative, if you

requested and received a printed copy of the proxy card by mail, you may complete, sign and date the proxy card in accordance with the instructions set forth in the proxy statement. You may also return the completed proxy card by

fax ormail in the postage-paid envelope

we have provided.provided with your request.

On behalf of the Board,

of Directors, thank you for your continued interest and support.

|

Sincerely, |

|

|

Luis A. Clavell-Rodríguez, MD |

Chair of the Board |

Sincerely,

Luis A. Clavell-Rodríguez, MD

Chair of the Board

March , 2017

TRIPLE-S MANAGEMENT CORPORATION

[THIS PAGE INTENTIONALLY LEFT BLANK]

Triple-S Management Corporation

San Juan, Puerto Rico 00936-3628

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

to be held on Wednesday, April 30, 2014

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

NOTICE IS HEREBY GIVEN that the

20142017 Annual Meeting of Shareholders will be held on

Wednesday,Friday, April

30, 2014,28, 2017, at 9:00 a.m.,

Atlanticlocal time,

in our corporate offices located at

the Atlantic Room of the InterContinental Resort and Casino Hotel, 5961 Isla Verde1441 F.D. Roosevelt Avenue,

Carolina,San Juan Puerto Rico

00979.At the meeting, shareholders will be asked to consider and vote on the following matters:

00920.

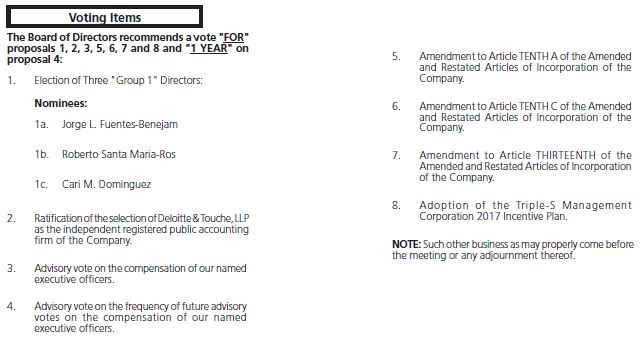

Items of business | | Shareholders will be asked to consider and vote on the following matters: 1. | The election of three nominees to serve as “Group 1” directors, each to serve for a three-year term; |

| term of three years; 2. | The ratification of the selection of PricewaterhouseCoopersDeloitte & Touche LLP as our independent registered public accounting firm for the current year; |

| 2017; 3. | An The consideration of an advisory resolution to approve the compensation of our named executive officers;4. The approval of an advisory vote on the frequency of future advisory votes on the compensation of our named executive officers; 5. The approval of an amendment to Article TENTH A of the Amended and |

| 4. | Restated Articles of Incorporation of the Company; 6. The approval of an amendment to Article TENTH C of the Amended and Restated Articles of Incorporation of the Company; 7. The approval of an amendment to Article THIRTEENTH of the Amended and Restated Articles of Incorporation of the Company; 8. The adoption of the Triple-S Management Corporation 2017 Incentive Plan; and 9. Any other business that may properly come before the meeting or any adjournment or postponement thereof. |

| | |

| Record date | | Shareholders of record of the Company at the close of business on February 28, 2017 are entitled to receive notice of, attend, and vote at the meeting. |

| | |

Your vote is important | | Please vote as promptly as possible by using the Internet, telephone, or by signing, dating and returning the completed proxy card in accordance with the instructions in the Notice or your proxy card. |

Only

Important notice regarding the availability of proxy materials

We are delivering the proxy materials to all our shareholders via the Internet, as permitted by U.S. Securities and Exchange Commission rules. Instead of sending a paper copy of the proxy materials, we are sending to our shareholders of record

at the close of business on March 3, 2014 are entitled to receive notice of, attend, and to vote at, the meeting.We urge all shareholders to attend the meeting in person or by proxy. Your vote is important no matter how many shares you own. Whether or not you plan to attend, you can vote your shares over the Internet or by telephone as we describe in the accompanying materials and thea Notice of Internet Availability of Proxy Materials. As an alternative, if you receivedMaterials (the “Notice”) with instructions on how to access the proxy materials and how to vote via the Internet.

Our proxy statement and the 2016 annual report to shareholders are available at our website http://www.triplesmanagement.com. Shareholders may request a printed copy of the proxy cardmaterials by mail, you may complete, sign, and date the proxy card in accordance withfollowing the instructions set forth in the Notice and the proxy statement. You may also return

By order of the

completed proxy card by fax or in the postage-paid envelope we have provided. Your prompt response is necessary to ensure that your shares are represented at the meeting. You can change your vote and revoke your proxy at any time before the polls close at the meeting, as explained in the accompanying proxy statement.Board of Directors,

Carlos L. Rodríguez-Ramos

Secretary

San Juan, Puerto Rico

March , 2017

[THIS PAGE INTENTIONALLY LEFT BLANK]

| 1 |

By order of the Board of Directors, |

|

|

Roberto García-Rodríguez |

Secretary |

|

San Juan, Puerto Rico |

March 21, 2014 |

TABLE OF CONTENTS

| | | | | | |

PROXY SUMMARY

| | | 2 | |

| 5 |

| |

| 6 |

| | 5 | |

| | |

| | ELECTION OF DIRECTORS | 12 |

| 12 |

| 1013 |

| 14 |

| 15 |

| |

| | |

| | RATIFICATION OF THE SELECTION OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 16 |

| 16 |

| 1416 |

| 17 |

| |

| | |

| | AN ADVISORY RESOLUTION TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | 18 |

| 18 |

16 | |

| 20 |

CORPORATE GOVERNANCE

| 20 |

| | 18 | |

| 21 |

| 21 |

| |

| 22 |

| 22 |

| |

| 22 |

| 23 |

| |

| 24 |

| 24 |

| |

| 28 |

| 28 |

| 29 |

| 29 |

| 29 |

| 30 |

| 30 |

| 33 |

| 34 |

| 34 |

| 35 |

| |

| 36 |

| | 24 | |

| |

| 37 |

| | 26 | |

| |

| 38 |

| 39 |

| 2639 |

| 48 |

| 49 |

| 49 |

| 50 |

| 58 |

| |

| 59 |

COMPENSATION DISCLOSURE

| 59 |

| | 28 | |

| |

COMPENSATION DISCUSSIONAND ANALYSIS

| | | 28 | |

RISK CONSIDERATIONSINOUR EXECUTIVE COMPENSATION PROGRAM

| | | 40 | |

COMPENSATION TABLES

| | | 41 | |

| |

AUDIT COMMITTEE MATTERS

| | | 51 | |

| |

| 60 |

| 60 |

| 5260 |

| |

| 61 |

INCORPORATION BY REFERENCE

| | |

53 | 61 |

i

TRIPLE-S MANAGEMENT CORPORATION

P.O. Box 363628

San Juan, Puerto Rico 00936-3628

PROXY STATEMENT

This summary highlights certain information about Triple-S Management Corporation (the “Company,” “we,” “our,” or “us”) and certain information contained elsewhere in this proxy statement for the Company’s 2017 Annual Meeting of

ShareholdersApril 30, 2014

shareholders (“the meeting”). This summary does not contain all of the information that you should consider. We encourage you to read the entire proxy statement carefully before voting.

Information about the meeting of shareholders

| · | Time and date: | Friday, April 28, 2017 at 9:00 a.m., local time. |

| · | Location: | 1441 F.D. Roosevelt Avenue, San Juan, Puerto Rico 00920. |

| · | Record Date: | Tuesday, February 28, 2017. |

| · | Voting: | All shareholders as of the record date are entitled to attend the meeting and vote. Each share of our common stock owned on the record date entitles the shareholder to one vote on each proposal presented for consideration. |

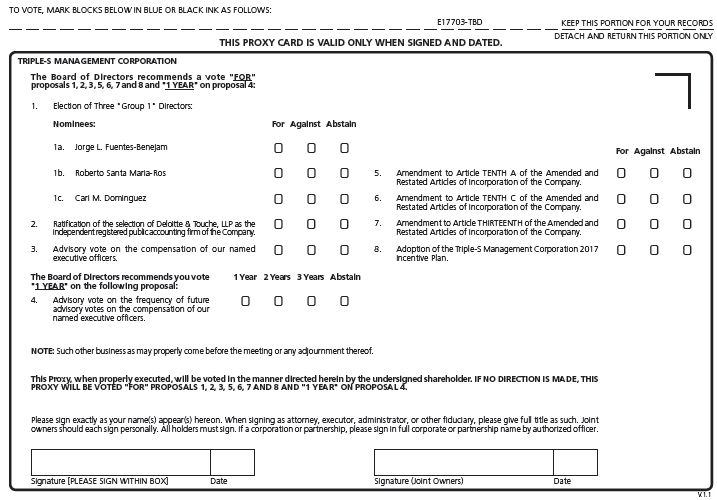

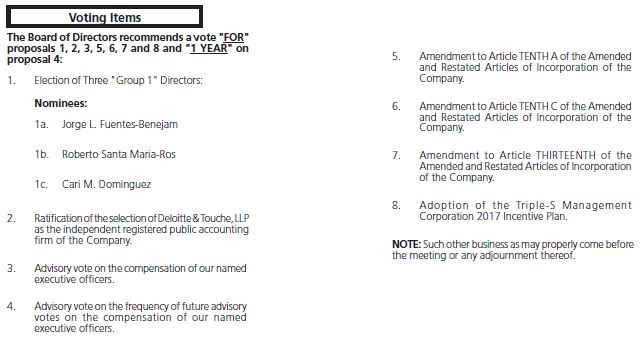

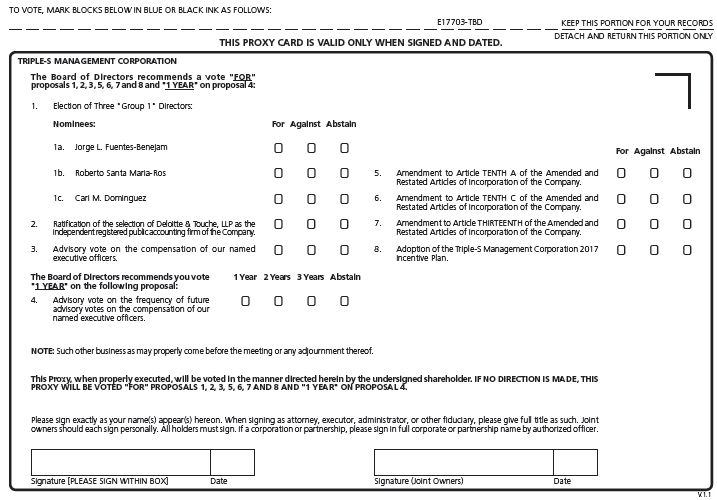

| Voting matters | Board recommendation | Page reference |

| · | Election of three “Group 1” directors. | FOR each nominee | 12 |

| · | Ratification of the selection of Deloitte & Touche LLP as the independent registered public accounting firm. | FOR | 16 |

| · | An advisory resolution to approve the compensation of our named executive officers. | FOR | 18 |

| · | An advisory vote on the frequency of future advisory votes on the compensation of our named executive officers. | 1 YEAR | 20 |

| · | Amendment to Article TENTH A of the Amended and Restated Articles of Incorporation of the Company. | FOR | 21 |

| · | Amendment to Article TENTH C of the Amended and Restated Articles of Incorporation of the Company. | FOR | 22 |

| · | Amendment to Article THIRTHEENTH of the Amended and Restated Articles of Incorporation of the Company. | FOR | 22 |

| · | Adoption of the Triple-S Management Corporation 2017 Incentive Plan. | FOR | 24 |

At the meeting, shareholders are being asked to vote for three “Group 1” directors, each for a three-year term. Each nominee currently serves as a director in our Board. Also, our Board has determined that each nominee is independent pursuant to the independence criteria outlined by the New York Stock Exchange and the BlueCross and BlueShield Association.

| Name | Age | Director since | Experience/Qualification | Committee memberships |

| Jorge L. Fuentes Benejam | 68 | 2008 | Public company knowledge; executive leadership | · Corporate Governance and Nominating (Chair) · Investment and Financing · Executive |

| Roberto Santa María-Ros | 65 | 2015 | Accounting and Financial | · Audit · Investment and Financing |

| Cari M. Dominguez | 67 | 2012 | Government and public policy experience; human resources knowledge; executive leadership | · Corporate Governance and Nominating · Compensation and Talent Development · Executive (Vice Chair) |

Corporate governance highlights

| · | 7 of our 9 current directors are independent.1 |

| · | Separate chair of the Board and chief executive officer positions. |

| · | Lead Independent Director. |

| · | Annual Board, committee, and individual director self-evaluations. |

| · | Stock ownership guidelines for directors. |

| · | Guidelines for annual continuing education of directors. |

| Visit www.proxyvote.com and follow the instructions in the Notice. |

| Scan the QR Code in the Notice, with your mobile phone and vote following the instructions in the Notice. |

| Call the telephone number in the Notice. |

| Send your completed and signed proxy card to Triple-S Management Corporation c/o Broadridge Financial Solutions, Inc. at 51 Mercedes Way, Edgewood, New York 11717. |

| Cast your vote in person if you are the registered shareholder or by obtaining a “legal proxy” if your shares are held in “street name” by completing and signing your proxy card at the meeting. |

Submitting proposals for the 2018 Annual Meeting of shareholders

| · | Deadline for shareholders proposal for inclusion in the 2018 proxy statement: | November 16, 2017 |

| · | Period for submitting proposals and nominations for directors to be considered at the 2018 Annual Meeting: | November 29, 2017 to December 29, 2017 |

Independent registered public accounting firm

As a matter of good corporate governance, our shareholders are being asked to ratify the selection of Deloitte & Touche LLP (“D&T”) as our independent registered accounting firm. Below is a summary of the fees that we paid or accrued in connection with services provided by D&T for 2016 and 2015.

| Type of Fees | | 2016 | | | 2015 | |

| Audit Fees | | $ | 2,902,600 | | | $ | 2,707,600 | |

| Audit-Related Fees | | $ | 431,860 | | | $ | 340,250 | |

| Tax Fees | | $ | 0 | | | $ | 0 | |

| All Other Fees | | $ | 300,888 | | | $ | 0 | |

| Total | | $ | 3,635,348 | | | $ | 3,047,850 | |

1 With the passing of Ms. Soto-Martinez on March 28, 2016, the Board currently consists of 9 members. Ms. Soto-Martinez’ seat on the Board remains vacant while the Board considers a candidate for director.

Executive compensation components

Components of our compensation plan are summarized below. Some components are inapplicable to certain executives, as further described in this proxy statement. For more information on the compensation of our executive officers, see the “Compensation discussion and analysis” section of this proxy statement.

| Component | Description |

| Fixed | | Base salary | ·Cash compensation to recognize individual contribution to the Company, taking into consideration the executive’s experience, knowledge and scope of responsibilities. ·Reviewed annually based on individual performance, market-level relative salary, the Company’s financial performance, and ability to pay. ·Adjusted if and when appropriate. |

| Variable | | Short-term cash incentive | ·Motivates individual to attain annual objectives and reinforces the optimization of operating results and corporate goals. ·May range from zero to 150% of the target opportunity. ·Company’s financial results account for 70% of each executive’s evaluation, and individual performance accounts for the remaining 30%. |

| Equity compensation | ·Promotes long-term success, the retention of talented individuals, and mitigation of excessive risk taking. ·75% as performance shares; payout range from zero to 150% from target opportunity over a 3-year performance period. ·25% as restricted shares vesting in equal installments over a 3-year period. |

| Variable | | Benefits and perquisites including retirement programs, non-qualified deferred compensation plan, health and life insurance, and vehicle allowance, among others. |

Other components of the compensation program

Our compensation program includes policies and practices that we believe promote good governance and align executive compensation with the interests of our shareholders.

| · | Have an equity grant policy with pre-scheduled grant dates to avoid backdating of equity awards. |

| · | Deliver 75% of annual long-term incentive in the form of performance shares. |

| · | Have an incentive compensation recoupment policy to ensure compensation is paid on accurate financial data. |

| · | Require executive officers, directors and other individuals to request pre-clearance to transact with our stock. |

| · | Engage an independent compensation consultant selected by, and that reports directly to, the Compensation and Talent Development Committee. |

| · | Have stock ownership guidelines requiring executive and other participants of equity compensation to own and retain Company stock. |

| · | No hedging on our Company stock. |

| · | No unusual or excessive perquisites. |

| · | No option awards. Grant of stock options was discontinued in 2010. |

| · | No cash severance payment upon change in control. Chief executive officer may only receive cash severance payment upon a change in control with termination of employment (“Double trigger”). |

2016 compensation summary

The compensation of our named executive officers (“NEOs”) for 2016 is summarized below. For more information, see the narrative and notes accompanying the 2016 summary compensation tables included in this proxy statement.

| Name and Position | | Salary | | | Bonus | | | Stock Awards | | | Non-Equity Incentive Plan Compensation | | | Change in Pension Value and Non- Qualified Deferred Compensation | | | All Other Compensation | | | Total | |

Roberto García-Rodríguez President and CEO | | $ | 744,385 | | | $ | 600 | | | $ | 1,874,972 | | | $ | 215,769 | | | $ | 0 | | | $ | 37,728 | | | $ | 2,873,454 | |

Juan J. Roman-Jimenez Executive Vice President and CFO | | $ | 471,154 | | | $ | 600 | | | $ | 749,981 | | | $ | 102,747 | | | $ | 45,000 | | | $ | 12,800 | | | $ | 1,382,282 | |

| Madeline Hernandez-Urquiza | | $ | 514,135 | | | $ | 600 | | | $ | 524,998 | | | $ | 150,186 | | | $ | 10,000 | | | $ | 33,683 | | | $ | 1,233,602 | |

| President of Triple-S Salud & Triple-S Advantage, Inc. | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Eva G. Salgado-Micheo | | $ | 391,516 | | | $ | 600 | | | $ | 374,979 | | | $ | 187,995 | | | $ | 180,000 | | | $ | 28,200 | | | $ | 1,163,290 | |

| President of Triple-S Propiedad, Inc. | | | | | | | | | | �� | | | | | | | | | | | | | | | | | | |

| Arturo L. Carrion-Crespo | | $ | 324,700 | | | $ | 600 | | | $ | 249,978 | | | $ | 153,760 | | | $ | 0 | | | $ | 44,000 | | | $ | 773,038 | |

| President of Triple-S Vida, Inc. | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

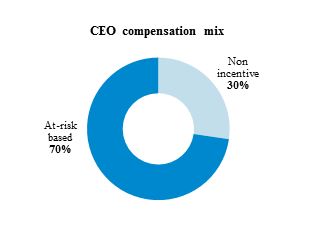

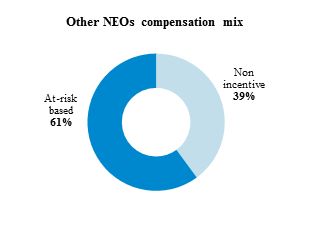

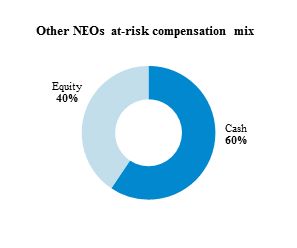

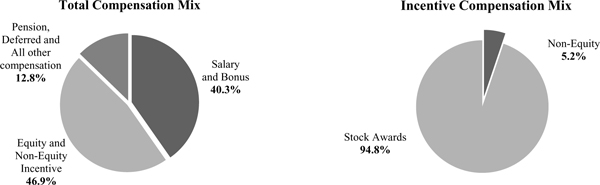

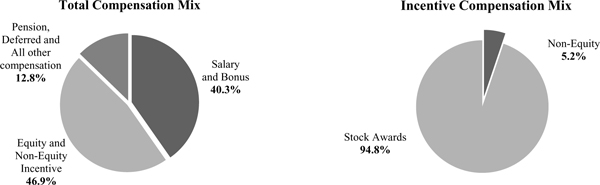

Compensation mix

For 2016, 70% of the total compensation approved to our CEO and 61% for our other NEOs was at-risk, variable compensation. Actual amounts realized depend on our annual and long-term performance and our Company’s stock price. Also, equity compensation granted comprised 63% of CEO compensation and 40% of all other NEOs compensation. We believe this compensation design promotes our executives to achieve the Company’s financial results while taking into consideration the impact of their decisions. The compensation mix of our CEO and our other NEOs is illustrated in the charts below, which considers maximum payout of approved performance equity grants and cash compensation.

PROXY STATEMENT FOR THE 2017 ANNUAL MEETING OF SHAREHOLDERS |

We are providing this proxy statement to our shareholders in connection with a solicitation of proxies by the Board of Directors (the “Board”) of

Triple-S Management Corporation (“Triple-S Management,” the

“Company,” “we,” “us,” or “our”)Company for use at the

2014 Annual Meeting of Shareholdersmeeting and at any adjournment or postponement of the meeting. We will hold the meeting on

Wednesday,Friday, April

30, 2014,28, 2017, beginning at 9:00 a.m.,

Atlantic Time,local time, in

the Atlantic Room of the InterContinental Resort and Casino Hotel, 5961 Isla Verdeour corporate offices located at 1441 F.D. Roosevelt Avenue,

Carolina,San Juan, Puerto Rico

00979.00920.

We are furnishing the proxy materials over the Internet pursuant to the rules of the

U.S. Securities and Exchange Commission (“SEC”). On or about March

21, 2014,16, 2017, we

will mail abegan mailing the Notice

of Internet Availability of Proxy Materials (the “Notice”) to

holdersour shareholders of record

as of

our Class B common stock at the close of business on

March 3, 2014. On or about the same date we will mailFebruary 28, 2017. The Notice contains instructions on how to

holders of our Class A common stock a printed copy ofaccess this proxy statement

and our

2013 Annual Reportannual report and

a proxy card. If you receive the Notice by mail, youhow to cast your vote. You will not receive a paper copy of the proxy materials unless you request one. The Notice will contain instructions on how to access the proxy materials over the Internet and vote online or by telephone. The Notice also contains instructions on how to request a paper copy of our proxy materials, free of charge.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on April 30, 2014:28, 2017: This proxy statement, our

20132016 Annual Report, the form of proxy and voting instructions are being made available to shareholders of record of our Class

A and Class B common stock on or about March

21, 2014,16, 2017 at

www.proxyvote.com.www.proxyvote.com. If you

receive the Notice and would still like to receive a printed copy of the proxy materials or our

20132016 Annual Report, including audited financial statements for the year ended December 31,

2013,2016, you may request a printed copy by: (a) telephone at 1-800-579-1639; (b) Internet at

www.proxyvote.com;www.proxyvote.com; or (c) e-mail at

sendmaterial@proxyvote.com.sendmaterial@proxyvote.com. Please make the request as instructed above on or before April

16, 201414, 2017 to facilitate timely delivery.

All proxies will be voted in accordance with the instructions they contain. If you do not provide voting instructions on your proxy card with respect to a particular matter, your shares will be voted in accordance with the recommendations of our Board.

INFORMATION ABOUT VOTING, SOLICITATION AND THE ANNUAL MEETING |

| | |

• Time and date:

Why am I receiving these materials? | | Wednesday, | Our Board is providing these materials to you to solicit proxies on its behalf to be voted at the meeting on April 30, 201428, 2017 at 9:00 a.m., Atlantic Timelocal time, at the offices of Triple-S Management Corporation, 1441 F.D. Roosevelt Avenue, San Juan, Puerto Rico 00920. |

| |

• Location:

Why did I receive a one-page notice in the mail instead of a full set of proxy materials? | | Atlantic Room | We have elected to deliver our proxy materials over the Internet to all our shareholders under the “notice and access” rules of the InterContinental ResortSEC. If you are a shareholder of record, we sent you a Notice by mail. You will not receive a printed copy of the proxy materials unless you request one. We encourage you to help us reduce the environmental impact of the meeting, and Casino Hotel, 5961 Isla Verde Avenue, Carolina, Puerto Rico 00979reduce the cost associated with printing and mailing of proxy materials by accessing the proxy materials over the Internet. |

| |

• Record Date:

How can I request a printed copy of the proxy materials? | | Monday, March 3, 2014 | You may request a printed copy of the proxy materials by calling 1-800-579-1639; or accessing www.proxyvote.com over the Internet; or by sending an email to sendmaterial@proxyvote.com. Please make the request on or before April 14, 2017 to facilitate timely delivery. |

| |

• Voting:

What should I do if I receive more than one Notice? | | All shareholders as

| You may receive more than one Notice. For example, you may receive a separate Notice if: (i) you hold Class A and Class B shares, or (ii) you hold Class B shares in more than one brokerage account. Please vote all your shares over the Internet, by telephone, or by signing and mailing all proxy cards or voting instruction forms that you receive. |

| Who can vote? | | | To be able to vote, you must have been a holder of record of our common stock at the close of business on February 28, 2017. This date is the “record date” for the 2017 Annual Meeting. Shareholders of record on the record date are entitled to vote. Eachreceive notice of, attend, and vote on each proposal at the meeting or on any postponement or adjournment of the meeting. |

| How many votes do I have? | | | You are entitled to one vote per each share of our common stock that you owned on the record date entitles the shareholder to one vote on each proposalmatter that is presented for consideration. |

Agenda of the 2014 Annual Meeting

| All shares of our Class A and Class B common stock will vote together as a single class on all matters brought before the meeting. |

• Election of three “Group 1” directors for three-year terms

|

|

• Ratification of the selection of PricewaterhouseCoopers LLP as independent registered public accounting firm

|

|

• An advisory resolution to approve the compensation of our named executive officers

|

|

• Act on any other business properly presented to the meeting or any adjournment or postponement thereof

|

| | | | |

Voting Matters

| | Board Recommendation

| | Page Reference

|

| | |

• Election of three “Group 1” directors

| | FOReach nominee | | 10 |

| | |

• Ratification of the selection of PricewaterhouseCoopers LLP as independent registered public accounting firm

| | FOR

| | 14 |

| | |

• An advisory resolution to approve the compensation of our named executive officers

| | FOR | | 16 |

“Group 1” Director Nominees

Our license agreement with the Blue Cross Blue Shield Association (“BCBSA”) requires that our Board be divided into three groups, with one group being elected each year and members of each group holding office for a three-year term. The following table provides information about each nominee who, if elected, will serve until the 2017 annual meeting of shareholders or until his/her successor is elected or qualified. In 2013, each of the nominees attended at least 75% of the Board meeting and committee meetings on which he or she sits. Our Board has determined that each nominee is independent pursuant to the independence criteria outlined by the New York Stock Exchange (“NYSE”).

| | | | | | | | |

Name | | Age | | Director since | | Experience/Qualification | | Committee Memberships |

Adamina Soto-Martínez | | 66 | | 2002 | | Financial; regulatory | | Audit (chair), Compensation, and Executive |

| | | | |

Jorge L. Fuentes-Benejam | | 65 | | 2008 | | Public company; executive leadership | | Governance (chair), Investment, and Executive |

| | | | |

Francisco J. Toñarely-Barreto | | 56 | | 2011 | | Marketing; international markets; strategic planning | | Governance and Compensation |

2015 Annual Meeting of Shareholders

| | |

• Deadline for shareholders proposal for inclusion in the proxy statement:

| | November 22, 2014 |

| |

• Period for submitting proposals and nominations for directors to

Who may be consideredpresent at the 2015 annual meeting: | | December 1, 2014 to

December 31, 2014.

|

2

Independent Registered Public Accounting Firm

As a matter of good corporate governance, our shareholders are being asked to ratify the selection of PricewaterhouseCoopers LLP as our independent registered accounting firm for 2014. Below is a summary of the fees that we paid or accrued in connection with services provided by PricewaterhouseCoopers LLP in 2013 and 2012.

| | | | | | | | |

Type of Fees | | 2013 | | | 2012 | |

Audit Fees | | $ | 2,477,636 | | | $ | 2,218,807 | |

Audit-Related Fees | | $ | 726,791 | | | $ | 256,929 | |

Tax Fees | | $ | 0 | | | $ | 0 | |

All Other Fees | | $ | 0 | | | $ | 0 | |

| | | | | | | | |

Total | | $ | 3,204,427 | | | $ | 2,475,736 | |

Executive Compensation Components

Components of our compensation plan are summarized below. Some components are inapplicable to certain executives, as further described in this proxy statement.

| | | | | | | | |

Element

meeting? | | | Only shareholders of record and beneficial owners with a legal proxy issued in their name by their respective organization holding their shares may be present at the meeting. No other person, including persons accompanying a shareholder, will be allowed at the meeting. Please bring a valid form of photo identification, such as a driver’s license or passport, to corroborate your identity as one of our shareholders. No video or audio recording will be allowed during the meeting. We encourage you to vote your shares in advance even if you plan to attend the meeting. |

| | Form

What constitutes a quorum for the meeting? | | | | Description

|

Cash | | •

•

| | Base salary

Performance-based annual incentive

| | •

| | Base salary increases are based on several factors, including individual performance, Company’s financial performance and ability to pay, and competitive analysis |

| | | | |

| | | | | | •

| | Incentive payout may range from zero to 150%At least one-third (1/3) of the target opportunity |

| | | | |

| | | | | | •

| | Financial results account for 80%shares entitled to vote must be present at the meeting, in person or by proxy, to constitute a quorum. As of each named executive officer’s evaluationthe record date, shares of common stock were issued and individual performance accounts foroutstanding. Shares of common stock represented in person or by proxy, “broker non-votes,” as discussed below, and shares that abstain or do not vote with respect to a particular proposal, will be treated as shares that are present to determine if there is a quorum. If a quorum is not present, we may propose to adjourn the remaining 20% |

| | | | |

| | | | | | •

| | Performance is reviewed on an annual basis |

| | | | |

Long-Term Incentive Equity Awards | | •

•

| | Performance shares

Restricted shares

| | •

| | 75% of total equity award value is tiedmeeting to specific operating performance measures |

| | | | | | •

| | Remaining 25% of award earned if the executive remains employed with the Company over the vesting period |

| | | | |

Retirement program | | •

•

•

| | Non-contributory defined-benefit pension plan

Supplemental defined-benefit retirement plan

Defined contribution savings plan

| | •

| | Only union employees and executives hired before December 19, 2006 and non-union employees hired before September 30, 2007 are eligible for the defined-benefit plans; all other employees and executives are eligible for a defined contribution savings plan |

| | | | |

Other | | •

| | Benefits and perquisites | | •

| | Non-qualified deferred compensation plan |

| | | | |

| | | | | | •

| | Health insurance |

| | | | |

| | | | | | •

| | Life insurance |

| | | | |

| | | | | | •

| | Vehicle allowancesolicit additional proxies. |

3

6

Other Information Related to our Executive Compensation Program

Stock ownership requirements

Equity award grant policy

Insider trading and anti-hedging policy

No trigger on change of control in equity plan

Double trigger on change of control in CEO employment contract

2013 Compensation Summary

The compensation of our named executive officers for 2013 is summarized below. For more information, see the narrative and notes accompanying the 2013 Summary Compensation Table set forth on page 41.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and Position | | Salary | | | Bonus | | | Stock

Awards | | | Non-Equity

Incentive Plan

Compensation | | | Change in

Pension Value

and Non-

Qualified

Deferred

Compensation | | | All Other

Compensation | | | Total | |

| | | | | | | |

Ramón M. Ruiz-Comas | | $ | 820,615 | | | $ | 0 | | | $ | 2,000,004 | | | $ | 0 | | | $ | 190,000 | | | $ | 30,000 | | | $ | 3,040,619 | |

President and CEO | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Amílcar L. Jordán-Pérez | | $ | 439,615 | | | $ | 0 | | | $ | 299,981 | | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 739,596 | |

Vice President of Finance and CFO | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Pablo Almodóvar-Scalley | | $ | 537,307 | | | $ | 0 | | | $ | 399,990 | | | $ | 0 | | | $ | 315,000 | | | $ | 28,200 | | | $ | 1,280,497 | |

President of Triple-S Salud, Inc. | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Arturo Carrión-Crespo | | $ | 318,443 | | | $ | 0 | | | $ | 209,987 | | | $ | 175,340 | | | $ | 0 | | | $ | 47,450 | | | $ | 751,310 | |

President of Triple-S Vida,Inc. | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Eva G. Salgado-Micheo | | $ | 378,842 | | | $ | 0 | | | $ | 224,998 | | | $ | 0 | | | $ | 70,000 | | | $ | 28,200 | | | $ | 702,040 | |

President of Triple-S Propiedad, Inc. | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Susan Rawlings-Molina | | $ | 409,712 | | | $ | 600 | | | $ | 374,996 | | | $ | 0 | | | $ | 0 | | | $ | 211,192 | | | $ | 996,500 | |

Former president of Triple-S Advantage Solutions, Inc. | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Compensation Mix

The compensation mix of our named executive officers for 2013 is graphically illustrated below and is based on the information presented in the compensation summary table.

4

INFORMATION ABOUT VOTING, SOLICITATION AND THE ANNUAL MEETING

Who can vote?

To be able to vote, you must have been a holder of record of our common stock at the close of business on March 3, 2014. This date is the “record date” for the annual meeting. Shareholders of record on the record date are entitled to receive notice of, to attend, and to vote on each proposal at the annual meeting or on any postponement or adjournment of the meeting. As of the close of business on the record date, there were 27,373,747 shares of our common stock outstanding, consisting of 2,377,689 issued and outstanding shares of Class A common stock (“Class A shares”) and 24,996,058 issued and outstanding shares of Class B common stock (“Class B shares”). Class A shares and Class B shares are sometimes referred to collectively in this proxy statement as “common stock.” In addition to shareholder of record of our common stock, beneficial owners of shares held in street name as of the record date can vote using the methods described below.

How many votes do I have?

You are entitled to one vote per each share of our common stock that you owned on the record date on each matter that is presented for consideration. All shares of our common stock will vote together as a single class on all matters brought before the meeting.

How do I vote if I am the holder of record of my shares?

If your shares of common stock are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, and not through a brokerage firm, bank, broker-dealer or other similar organization, you are considered the “shareholder of record” with respect to those shares. We have sent the Notice or the printed proxy materials directly to you. If you are the shareholder of record or “record holder” of your shares, you may vote in one of the following five ways:

| | •What is the difference between a shareholder of record and a beneficial owner of shares held in street name? | | | Shareholder of record. If your shares of common stock are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, and not through a brokerage firm, bank, broker-dealer or other similar organization, you are considered the “shareholder of record” with respect to those shares. We have sent the Notice directly to you. Beneficial owner of shares held in street name. If your shares are held in an account at a brokerage firm, bank, broker-dealer or other similar organization, then you are the “beneficial owner” of shares held in “street name,” and a Notice should be sent to you by that organization. You have the right to instruct that organization how to vote your shares. |

| How do I vote if I am the shareholder of record of my shares? | | | If you are the shareholder of record, you may vote in one of the following four ways: ·Through the Internet. Vote by following the instructions on the Notice or going to the Internet address stated on your proxy card. |

| • | | ·By telephone. Call the telephone number provided on your proxy card. |

| • | | ·By faxmail. CompleteIf you requested and sign your proxy card and fax both sidesreceived a printed copy of the completed proxy card to (787) 749-4148. |

| • | | By mail. Completematerials or downloaded the proxy materials over the Internet, you can complete and sign your proxy card and mail it in the enclosed postage-prepaid envelope. You do not need to affix a stamp on the enclosed envelope if you mail it within the United States. If you do not have the postage-prepaid envelope, please mail your completed proxy card to the following address:Triple-S Management Corporation c/o Broadridge Financial Solutions, Inc. at 51 Mercedes Way Edgewood, NY 11717. |

| • | | New York 11717 ·In person. Attend the annual meeting and vote in person or by submitting ayour proxy card at the meeting. |

If you only receive the Notice, you may follow the instructions outlined in the Notice to request a proxy card in order to submit your vote by fax or mail.If you vote via the Internet, by phone, or by fax, do not return the proxy card. You may request a printed copy of the proxy materials by: (a) telephone at 1-800-579-1639; (b) Internet at www.proxyvote.com; or (c) e-mail at sendmaterial@proxyvote.com. Please make the request on or before April 16, 2014 to facilitate timely delivery.

The Internet and telephone voting facilities will close at 11:59 p.m., Eastern Daylight Time, on April 29, 2014. If you plan to vote by fax or by mail, your proxy card must be received no later than 12:00 p.m., Eastern Daylight Time, on April 29, 2014.

In order to ensure that your proxy is voted according to your instructions and to avoid delays in ballot taking and counting, we request that you provide your full title when signing a proxy as attorney-in-fact, executor, administrator, trustee, guardian, authorized officer of a corporation, or on behalf of a minor. If shares are registered in the name of more than one record holder, all record holders must sign the proxy card.

5

How do I vote if my shares are held in “street name”?

If your shares are held in an account at a stock brokerage firm, bank, broker-dealer or other similar organization, then you are the “beneficial owner” of shares held in “street name.” Such organization is considered to be the shareholder of record with respect to those shares. If you hold your shares of common stock in street name you will receive the Notice from that organization with instructions on how to vote your shares. The organization that holds your shares will allow you to deliver your voting instructions via the Internet and may also permit you to submit your voting instructions by telephone. In addition, you may request paper copies of our proxy statement and proxy card by following the instructions on the Notice provided by the organization.

If you are a beneficial owner of shares held in street name and wish to vote in person at the annual meeting, you must present a “legal proxy,” issued in your name by the organization that holds your shares to be admitted to the meeting. A legal proxy is a document that will authorize you to vote your shares held in street name at the meeting. Please contact the organization that holds your shares for instructions to obtain a legal proxy.You must bring a copy of the legal proxy to the annual meeting and ask for a ballot from an usher when you arrive. In order for your vote to be counted, you must hand both the copy of the legal proxy and your completed ballot to an usher to be provided to the inspector of election.

Can I change or revoke my vote after I have voted?

Yes. You can change your vote or revoke your proxy at any time before the taking of votes at the annual meeting by:

delivering a written notice of revocation to our Secretary at or before the meeting;

Completing and sending the proxy card. Provide your full title when signing a proxy as attorney-in-fact, executor, administrator, trustee, guardian, authorized officer of a corporation, or on behalf of a minor to ensure your proxy card is voted according to your instructions and to avoid delays in ballot taking and counting. If shares are registered in the name of more than one record holder, all record holders must sign the proxy card. If you vote via the Internet or by phone, do not return the proxy card.

Closing of voting facilities. The Internet and telephone voting facilities will close at 11:59 p.m., Eastern time, on April 27, 2017. If you plan to vote by mail, your proxy card must be received no later than 12:00 p.m., Eastern Time, on April 27, 2017.

submitting another proxy by telephone or via the Internet prior the applicable cutoff time;

submitting another proxy by fax or mail prior to the applicable cutoff time;

presenting to our Secretary, before or at the meeting before polls close, a later dated proxy executed by the person who executed the prior proxy; or

voting in person at the meeting.

If you provide more than one proxy, the properly signed proxy having the latest date will revoke any earlier proxy. Attendance at the meeting will not automatically revoke a proxy unless you properly vote at the meeting or specifically request that your prior proxy be revoked. Any written notice of revocation or delivery of a subsequent proxy by a shareholder of record may be sent to our Secretary at Triple-S Management Corporation, 1441 F.D. Roosevelt Avenue, 6th Floor, San Juan, Puerto Rico 00920, or hand delivered to our Secretary at or before the voting at the annual meeting.

If your shares are held in street name by an organization, you must contact that organization to change your vote or, if you intend to be present and vote at the meeting, bring the legal proxy issued in your name by such organization to the meeting.

What should I do if I receive more than one set of voting materials?

You may receive more than one set of voting materials, including multiple copies of this proxy statement and proxy card. For example, (i) if you hold your Class B shares in more than one brokerage account, you may receive a separate Notice for each brokerage account in which you hold shares, and (ii) if you hold both Class A shares and Class B shares, you may receive paper copies of the proxy materials with respect to your Class A shares and a Notice with respect to your Class B shares. Please vote each proxy card that you receive.

Who may be present at the meeting?

Only shareholders of record and beneficial owners with a legal proxy issued in their name by their respective organization holding their shares may be present at the meeting. No other person, including persons accompanying a

6

shareholder, will be allowed at the meeting. Please bring a valid form of photo identification such as a driver’s license or passport to corroborate your identity as one of our shareholders.

No cameras, mobile phones, computers, tablets, recording equipment, electronic devices, large bags, briefcases or packages will be permitted in the meeting.

What constitutes a quorum for the meeting?

The presence at the beginning of the meeting, in person or by proxy, of one third (1/3) of the shares entitled to vote will constitute a quorum for the meeting. As of the record date, 27,373,747 shares of common stock were issued and outstanding. Shares of common stock represented in person or by proxy, “broker non-votes,” as discussed below, and shares that abstain or do not vote with respect to a particular proposal, will be treated as shares that are present for purposes of determining whether a quorum exists at the meeting.

We urge you to vote by proxy even if you plan to attend the meeting so that we will know as soon as possible that enough shares will be present to constitute a quorum in order for us to hold the meeting. If a quorum is not present, we may propose to adjourn the meeting to solicit additional proxies.

What happens if I do not give specific voting instructions?

If you are a shareholder of record and you indicate when voting on the Internet or by telephone that you wish to vote as recommended by the Board, or sign and return a proxy card without giving specific voting instructions, then the persons named as proxy holders will vote your shares in the manner recommended by the Board on all matters presented in this proxy statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the meeting and at any postponement or adjournment thereof.

If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions then, under applicable rules, the organization that holds your shares may generally vote on “routine” matters but cannot vote on “non-routine” matters unless the organization receives voting instructions from you. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization will inform the inspector of election that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a “broker non-vote.” In order to minimize the number of broker non-votes, the Company encourages you to vote or provide voting instructions with respect to each proposal to the organization that holds your shares by carefully following the instructions provided in the Notice or voting instruction form.

Which proposals are considered routine or non-routine?

The election of directors (Proposal 1) and the advisory resolution to approve the compensation of our named executive officers (Proposal 3) are considered non-routine matters under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore broker non-votes may exist in connection with Proposals 1 and 3. The ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the current year (Proposal 2) is considered a routine matter under applicable rules. A broker or other nominee may generally vote on routine matters, and therefore it is likely that no broker non-votes will exist in connection with Proposal 2.

What vote is required to approve each proposal?

Proposal 1—Election of Directors. A nominee must be elected to our Board by the affirmative vote of a majority of votes cast with respect to such nominee by the shares of common stock entitled to vote and present at the meeting or represented by proxy. If shareholders do not elect a director nominee who is already serving as a director, Puerto Rico corporation law provides that the director will continue to serve on our Board as a “holdover” director until his or her successor is elected.

Proposal 2—Ratification of the Selection of the Independent Registered Public Accounting Firm. The approval of this proposal requires the affirmative vote of a majority of votes cast with respect to this proposal by the shares of common stock entitled to vote and present at the meeting or represented by proxy.

7

Proposal 3—An Advisory Resolution to Approve the Compensation of Our Named Executive Officers. The approval of this proposal requires the affirmative vote of a majority of votes cast with respect to this proposal by the shares of common stock entitled to vote and present at the meeting or represented by proxy.

An “affirmative vote of a majority of votes cast” on a proposal means that the votes cast “for” the proposal exceeds the votes cast “against” such proposal. Abstentions and broker non-votes will not count as a vote “for” or “against” the proposal and thus will have no effect in determining whether the proposal has received the affirmative vote of a majority of the votes cast at the meeting.

Who will count the votes?

Representatives of Broadridge Financial Solutions, Inc., an independent third party, will act as inspectors of the election and tabulate the votes cast by proxy or in person at the meeting.

What are the Board’s recommendations?

The Board’s recommendation for each proposal is set forth below.

| | |

| How do I vote if I am a “beneficial owner”? | | | If you are a beneficial owner you will receive the Notice from the organization that holds your shares with instructions on how to vote your shares. That organization will allow you to deliver your voting instructions via the Internet and may also permit you to submit your voting instructions by telephone. In addition, you may request paper copies of our proxy statement and proxy card by following the instructions on the Notice provided by the organization. You can vote in person at the meeting, but you must bring at the meeting a “legal proxy” issued in your name by the organization that holds your shares. The legal proxy authorizes you to vote your shares held in street name at the meeting. Contact the organization that holds your shares for instructions on how to obtain a legal proxy. You must bring a copy of the legal proxy to the meeting and ask for a ballot in order to cast your vote in person. In order for your vote to be counted, you must hand the copy of the legal proxy with your completed ballot when you cast your vote. |

| Can I change or revoke my vote after I have voted? | | | Yes. You can change your vote or revoke your proxy at any time before the taking of votes at the meeting by delivering a written notice of revocation to our Secretary at or before the meeting; or by submitting another proxy by mail, telephone or the Internet prior to the applicable cutoff time; or by presenting to our Secretary, before or at the meeting before polls close, a later dated proxy executed by the person who executed the prior proxy; or by voting in person at the meeting. If you elect to revoke your vote by delivering a written notice of revocation or by submitting another proxy by mail to our Secretary, deliver it to the following address: Triple-S Management Corporation c/o Carlos L. Rodríguez-Ramos, Secretary 1441 F.D. Roosevelt Avenue, 6th Floor San Juan, Puerto Rico 00920 If you provide more than one proxy, the properly signed proxy having the latest date will revoke any earlier proxy. Attending the meeting will not automatically revoke a proxy unless you properly vote at the meeting or specifically request that your prior proxy be revoked. If you are a beneficial owner, you must contact the organization that holds your shares to change your vote or, if you intend to be present and vote at the meeting, bring the legal proxy issued in your name by such organization to the meeting. |

| What happens if I do not give specific voting instructions? | | | If you are a shareholder of record and you indicated when voting on the Internet or by telephone that you wish to vote as recommended by the Board, or you signed and returned a proxy card without giving specific voting instructions, then the persons named as proxy holders will vote your shares in the manner recommended by the Board on all matters presented in this proxy statement and, as proxy holders, may determine in their discretion with respect to any other matters properly presented for a vote at the meeting and at any postponement or adjournment thereof. If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions then, under applicable rules, the organization that holds your shares may generally vote on “routine” matters but cannot vote on “non-routine” matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization will inform the inspector of election that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a “broker non-vote.” In order to minimize the number of broker non-votes, the Company encourages you to vote or provide voting instructions with respect to each proposal to the organization that holds your shares by carefully following the instructions provided in the Notice or voting instruction form. |

| Who will count the votes? | | | A representative of Broadridge Financial Solutions, Inc., an independent third party, will act as the inspector of the election and tabulate the votes cast by proxy or in person at the meeting. |

| Which proposals are considered routine or non-routine? | | | The election of directors (Proposal 1), the advisory resolution to approve the compensation of our NEOs (Proposal 3), the advisory vote on the frequency of the advisory vote on the compensation of our NEOs (Proposal 4), the approval of the amendments to the Amended and Restated Articles of Incorporation of the Company (Proposal 5, Proposal 6, Proposal 7), and the approval of the Triple-S Management 2017 Incentive Plan (Proposal 8) are considered non-routine matters under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore broker non-votes may exist in connection with Proposals 1 and Proposal 3 through 8. The ratification of the selection of D&T as our independent registered public accounting firm for 2017 (Proposal 2) is considered a routine matter under applicable rules. A broker or other nominee may generally vote on routine matters, and therefore it is likely that no broker non-votes will exist in connection with Proposal 2. |

| What is the required vote to approve each proposal? | | | Election of directors (Proposal 1). A nominee must be elected to our Board by the affirmative vote of a majority of votes cast with respect to such nominee by the shares of common stock entitled to vote and present at the meeting or represented by proxy. If shareholders do not elect a nominee who is already serving as a director, Puerto Rico corporation law provides that the director will continue to serve on our Board as a “holdover” director until a successor is elected. An “affirmative vote of a majority of votes cast” on a proposal means that the votes cast “for” the proposal exceed the votes cast “against” such proposal. Abstentions and broker non-votes will not count as a vote “for” or “against” the proposal and thus will have no effect in determining whether the proposal has received the affirmative vote of a majority of the votes cast at the meeting. Ratification of the selection of the independent registered public accounting firm (Proposal 2). The approval of this proposal requires the affirmative vote of the holders of a majority of the shares of common stock entitled to vote and present at the meeting or represented by proxy. Abstentions will have the same effect as votes “against” this proposal and broker non-votes will have no effect on the proposal. Approval of the compensation of our named executive officers (Proposal 3). The approval, on an advisory basis, of this proposal requires the affirmative vote of the holders of a majority of the shares of common stock entitled to vote and present at the meeting or represented by proxy. Abstentions will have the same effect as votes “against” this proposal and broker non-votes will have no effect on this proposal. Advisory vote on the frequency of future advisory votes on the compensation of our named executive officers (Proposal 4). The approval of this proposal requires the affirmative vote of the holders of a majority of the shares of common stock entitled to vote and present at the meeting or represented by proxy. Abstentions will have the same effect as votes “against” this proposal and broker non-votes will have no effect on this proposal. With respect to this proposal, if none of the frequency alternatives receive a majority vote, we will consider the frequency that receives the highest number of votes by shareholders to be the frequency that has been selected by shareholders. However, because this vote is advisory and not binding on us or our Board in any way, our Board may decide that it is in our and our shareholders’ best interests to hold an advisory vote on executive compensation more or less frequently than the alternative approved by our shareholders. Approval of the Amendments to the Amended and Restated Articles of Incorporation of the Company (Proposal 5, Proposal 6 and Proposal 7). The approval of these proposals require the affirmative vote of a majority of the issued and outstanding shares of common stock, entitled to vote, as of the record date. Abstentions and broker non-votes will have the same effect as votes “against” these proposals. Additionally, the failure to vote will have the same effect as a vote “against” these proposals. Adoption of the Triple-S Management 2017 Incentive Plan (Proposal 8). The approval of this proposal requires the affirmative vote of the holders of a majority of the shares of common stock entitled to vote and present at the meeting or represented by proxy. Abstentions will have the same effect as votes “against” this proposal and broker non-votes will have no effect on this proposal. |

| How does the Board recommend to vote on the proposals? | | | The Board recommends shareholders to vote as set forth below. Election of Directors (page 10)(Proposal 1). | | The Board recommends a vote “FOR” FOR each nominee. |

| |

| of the three nominees. Ratification of the Selectionselection of the Independentindependent registered public accounting firm (Proposal 2). FOR the ratification of D&T as our independent registered public accounting firm for 2017. Approval of the compensation of our named executive officers (Proposal 3). FOR the approval, on an advisory basis, of the compensation of our named executive officers. Advisory vote on the frequency of future advisory votes on the compensation of our named executive officers (Proposal 4). 1 YEAR on the frequency of future advisory votes on the compensation of the Company’s named executive officers. Amendment to Article TENTH A of the Amended and Restated Articles of Incorporation of the Company (Proposal 5). FOR the approval of the amendment to Article TENTH A the Amended and Restated Articles of Incorporation of the Company. Amendment to Article TENTH C of the Amended and Restated Articles of Incorporation of the Company (Proposal 6). FOR the approval of the amendment to Article TENTH C the Amended and Restated Articles of Incorporation of the Company. Amendment to Article THIRTEENTH of the Amended and Restated Articles of Incorporation of the Company (Proposal 7). FOR the approval of the amendment to Article THIRTEENTH of the Amended and Restated Articles of Incorporation of the Company. Adoption of the Triple-S Management 2017 Incentive Plan (Proposal 8). FOR the adoption of the Triple-S Management 2017 Incentive Plan. |

| Will any other business be conducted on at this meeting? | | | We do not know of any other business that may come before the meeting other than as described in the Notice. The Board recommendschair of the meeting will declare out of order and disregard the conduct of any business not properly presented. However, if any new matter requiring the vote of our shareholders is properly presented before the meeting, proxies may be voted with respect thereto at the discretion of the proxy holders. The affirmative vote of the holders of a majority of the shares of common stock entitled to vote “FOR” this proposal.and present at the meeting or represented by proxy with respect to any other item properly presented at the meeting will be required for approval of such item, unless a greater percentage is required by law, our articles of incorporation or our bylaws. |

Registered Public Accounting Firm (page 14) | Where can I find the voting results of the meeting? | | | We will announce preliminary voting results at the meeting and publish voting results in a Current Report on Form 8-K, which will be filed with the SEC within four business days following the meeting. |

| |

Advisory Resolution to ApproveWhat is the Compensationcost and method of Our Named Executive Officers (page 16)soliciting proxies? | | The Board recommends a vote “FOR” this proposal. | We will bear the costs of soliciting proxies. We will also reimburse banks, brokers or other custodians, nominees and fiduciaries representing beneficial owners for their reasonable out-of-pocket expenses incurred in distributing proxy materials to shareholders and obtaining their votes. In addition, our directors, officers and employees may solicit proxies on the Company’s behalf in person, by telephone, or email without additional compensation. |

| What happens if the meeting is postponed or adjourned? | | | Your proxy will still be valid and may be voted at the postponed or adjourned meeting. You will still be able to change or revoke your proxy at any time before it is voted. |

Will any other business be conducted on at this meeting?

We do not know

| How and when may I submit a shareholder proposal, including a shareholder nomination for director, for the 2018 annual meeting of shareholders? | | | If you are interested in submitting a proposal for inclusion in the proxy statement for the 2018 annual meeting of shareholders, you need to follow the procedures outlined in Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). To be eligible for inclusion, we must receive the shareholder’s proposal for our proxy statement for the 2018 annual meeting of shareholders at our principal corporate offices in San Juan, Puerto Rico, at the address below no later than November 16, 2017. In addition, our bylaws require that we be given advance written notice of director nominations for election to our Board and other matters that shareholders wish to present for action at an annual meeting, other than those to be included in our proxy statement under Rule 14a-8 of the Exchange Act. The Secretary must receive such notice from a shareholder of record at the address noted below not less than 120 days or more than 150 days before the first anniversary of the preceding year’s annual meeting. However, if the date of our annual meeting is advanced by more than 30 days, or delayed by more than 60 days, from the anniversary date, then we must receive such notice at the address noted below not later than the close of business on the tenth day after the day on which public disclosure of the meeting was made. Assuming that the 2018 annual meeting is not advanced by more than 30 days nor delayed by more than 60 days from the anniversary date of the meeting, you would need to give us appropriate notice of the proposal at the address noted below no earlier than the close of business on November 29, 2017, and no later than the close of business on December 29, 2017. If a shareholder of record does not provide timely notice of a nomination or other matters to be presented at the 2018 annual meeting, it will not appear in the notice of meeting. If you are a beneficial owner, you can contact the organization that holds your shares for information about how to register your shares directly in your name as a shareholder of record. Our bylaws also specify requirements relating to the content of the notice that shareholders of record must provide to our Secretary for any matter, including a shareholder proposal or nomination for director, to be properly presented at a shareholder meeting. A copy of the full text of our bylaws is on file with the SEC and available on our website at www.triplesmanagement.com. Any proposals, nominations or notices should be sent to: Triple-S Management Corporation c/o Carlos L. Rodríguez-Ramos, Secretary 1441 F.D. Roosevelt Avenue, 6th Floor San Juan, Puerto Rico 00920 |

PROPOSAL 1 — ELECTION OF DIRECTORS |

Our Board has nominated Messrs. Jorge L. Fuentes-Benejam and Roberto Santa María-Ros, and Mrs. Cari M. Dominguez to serve as Group 1 directors, each for a three-year term until the

meeting other than as described in the notice of meeting. The chair of the meeting will declare out of order and disregard the conduct of any business not properly presented. However, if any new matter requiring the vote of our shareholders is properly presented before the meeting, proxies may be voted with respect thereto at the discretion of the proxy holders. The affirmative vote of a majority of votes cast by the shares of common stock entitled to vote and present, in person or by proxy, at the meeting with respect to any other item properly presented at the meeting will be required for approval of such item, unless a greater percentage is required by law, our articles of incorporation or our bylaws.Where can I find the voting results of the meeting?

We will publish the voting results in a Current Report on Form 8-K, which the Company is required to file with the SEC, within four business days following the meeting.

What is the cost and method of soliciting these proxies?

We will bear the costs of soliciting proxies. In addition, our directors, officers and employees may solicit proxies on the Company’s behalf in person, by telephone, facsimile or email without additional compensation. We also will reimburse banks, brokers or other custodians, nominees and fiduciaries representing beneficial owners of shares held in street name for their reasonable out-of-pocket expenses incurred in distributing proxy materials to shareholders and obtaining their votes.

How and when may I submit a shareholder proposal, including a shareholder nomination for director, for the 20152020 annual meeting of shareholders?

If you are interested in submittingor until a proposal for inclusion in the proxy statement for the 2015 annual meeting of shareholders, you need to follow the procedures outlined in Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). To be eligible for inclusion, we must receive your shareholder proposal for our proxy

8

statement for the 2015 annual meeting of shareholders at our principal corporate offices in San Juan, Puerto Rico, at the address below no later than November 22, 2014.

In addition, our bylaws require that we be given advance written notice of director nominations for election to our Boardsuccessor is elected and other matters that shareholders wish to present for action at an annual meeting, other than those to be included in our proxy statement under Rule 14a-8 of the Exchange Act. The Secretary must receive such notice from a shareholder of record at the address noted below not less than 120 days or more than 150 days before the first anniversary of the preceding year’s annual meeting. However, if the date of our annual meeting is advanced by more than 30 days, or delayed by more than 60 days, from the anniversary date, then we must receive such notice at the address noted below not later than the close of business on the tenth day after the day on which public disclosure of the meeting was made. Assuming that the 2015 annual meeting is not advanced by more than 30 days nor delayed by more than 60 days from the anniversary date of the 2014 annual meeting, you would need to give us appropriate notice at the address noted below no earlier than the close of business on December 1, 2014, and no later than the close of business on December 31, 2014. If a shareholder of record does not provide timely notice of a nomination or other matters to be presented at the 2015 annual meeting, it will not appear in the notice of meeting. If you are a beneficial owner of shares held in street name, you can contact the organization that holds your shares for information about how to register your shares directly in your name as a shareholder of record.

Our bylaws also specify requirements relating to the content of the notice that shareholders of record must provide to our Secretary for any matter, including a shareholder proposal or nomination for director, to be properly presented at a shareholder meeting. A copy of the full text of our bylaws is on file with the SEC and available on our Internet website, www.triplesmanagement.com.

Any proposals, nominations or notices should be sent to:

Roberto García-Rodríguez

Secretary

Triple-S Management Corporation

1441 F.D. Roosevelt Avenue, 6th Floor

San Juan, Puerto Rico 00920

What happens if the meeting is postponed or adjourned?

Your proxy will still be valid and may be voted at the postponed or adjourned meeting. You will still be able to change or revoke your proxy at any time before it is voted.

9

qualified.

Recommendation:Vote FOR each nominee.

PROPOSAL 1 — ELECTION OF DIRECTORSOverview

Our Board is divided into three groups, with one group being elected each year and members of each group holding office for a three-year term. This classified board structure is required by our articles of incorporation and by the terms of our license agreement with the BCBSA.BlueCross and BlueShield Association (“BCBSA”). Our Board has fixed the number of directors at ten. With the passing of Ms. Adamina Soto-Martínez on March 28, 2016, the Board currently consists of eleven members;nine members: three Group 1 directors (with terms expiring at the 20142017 annual meeting), threetwo Group 2 directors (with terms expiring at the 20152018 annual meeting), and fourthree Group 3 directors (with terms expiring at the 20162019 annual meeting). Our and our president and chief executive officer, which is an ex-officio member of our Board and is excluded from the three director groups.groups pursuant to the articles of incorporation of the Company. At thethis annual meeting our shareholders will have the opportunity to vote on an amendment to the articles of incorporation of the Company to eliminate the provision by which the Company’s President and chief executive officer is a member of the Board without shareholder approval (Proposal 6). Ms. Soto-Martínez’s seat on the board remains vacant while the Board considers a candidate for director.

Our articles of incorporation and our license with the BCBSA require our Board to be comprised of three

(3)groups as equal in number as possible. Our bylaws authorize the Board to alter the total number of directors serving on our Board, fix the exact number of directors serving in each group, nominate directors for shorter terms of office, and assign nominees

to a specific group to ensure that the group size requirement is met. Accordingly, the Board nominated three individuals to serve as Group 1 directors,

who will serveeach for a three-year

term until the 2017 annual meeting or until a successor is elected and qualified. All nomineesterm. Nominees are current directors. The affirmative vote of a majority of the votes cast by the shares of common stock entitled to vote and present or represented by proxy at the meeting is required to elect each nominee.

The persons named as proxies in the proxy card will vote for each of these nominees unless you instruct otherwise on the proxy card.

Each nominee hasNominees have indicated

her or histheir willingness and ability to serve, if elected. However, if any or all of the nominees should be unable or unwilling to serve, the proxies may be voted for a substitute nominee designated by our Board or our Board may reduce the number of directors.

Proxies cannot be voted for a greater number of persons than the number of nominees. We have no knowledge that any nominee will become unavailable for election.

Director Qualifications

Information about the nominees and directors continuing in office

The following candidates for election have been nominated by the Board based on the recommendation of the Corporate Governance and Nominating Committee.

TheBelow you will find information

presented below includes informationabout the nominees and directors whose terms in office will continue after the

annual meeting,

have given us aboutincluding their age, positions held, their principal occupation, business experience and directorships (including positions held in our Board’s committees, if any) for at least the past five years. In addition, we have included information regarding each nominee’s and director’s specific experience, qualifications, attributes and skills that led our Board to conclude that the nominees and directors should serve as members of the Board. We believe that all of our nominees and directors have a reputation

forof integrity, honesty and adherence to high ethical standards. Also, they each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to the Company, which taken as a whole, enable the Board to satisfy its oversight responsibilities in light of our business and structure.

The information presented about each nominee for election and director

continuing in office is as of the date of this proxy statement. Information about the number of shares of common stock beneficially owned by each

directorof the nominees and directors appears below under the heading “Security

Ownershipownership of

Certain Beneficial Ownerscertain beneficial owners and

Management.management.” See also “Other

Relationships, Transactionsrelationships, transactions and

Events.events.” There are no family relationships among any of our directors and executive officers.

Nominees for Election

ADAMINA SOTO-MARTÍNEZ, CPA, VICE CHAIR OF THE BOARD, DIRECTOR SINCE 2002. Ms. Soto-Martínez, age 66, is a certified public accountant and a founding partner of the accounting firm of Kevane Grant Thornton, LLP, where she worked from 1975 until her retirement in October 2009. She was the managing partner of the firm during the last sixteen years of her professional career. She is the chair of the Board’s Audit Committee, and member of the Compensation and Talent Development Committee and the Executive Committee. Ms. Soto-Martínez is a NACD Board Leadership Fellow. We believe Ms. Soto-Martínez’ profound knowledge of public accounting and financial auditing, as well as her experience in advising complex business organizations over the last thirty years, make her a skilled advisor to the Company and qualify her to sit on the Board.

JORGE L. FUENTES-BENEJAM, PE, DIRECTOR SINCE APRIL 2008. Mr. Fuentes-Benejam, age 65, was chair of the board, president and chief executive officer from 1986 until 2010, and is currently chair and CEO of Gabriel Fuentes Jr. Construction Co. Inc, a heavy and marine construction business, and of Fuentes Concrete Pile Co. Inc., a precast concrete pile manufacturing business, and related entities. Currently, Mr. Fuentes-Benejam is a member of the board of trustees of Interamerican University, Puerto Rico’s largest private university. He is the chair of the Board’s Corporate Governance and Nominating Committee, and member of the Investment and Financing Committee and the Executive Committee. Mr. Fuentes-Benejam is a NACD Board Leadership Fellow. We believe Mr. Fuentes-Benejam’s qualifications to sit on our Board include his knowledge of the Puerto Rico business environment, particularly in the construction industry—one of the key industries we serve—as well as his management and board

10